See Resolving Insolvency data here.

Doing Business studies the time, cost and outcome of insolvency proceedings involving domestic entities as well as the strength of the legal framework applicable to judicial liquidation and reorganization proceedings. The data for the resolving insolvency indicators are derived from questionnaire responses by local insolvency practitioners and verified through a study of laws and regulations as well as public information on insolvency systems. The ranking of economies on the ease of resolving insolvency is determined by sorting their scores for resolving insolvency. These scores are the simple average of the scores for the recovery rate and the strength of insolvency framework index.

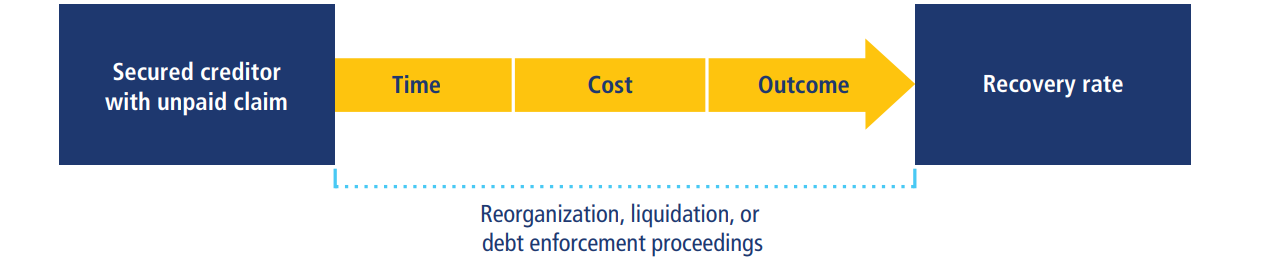

Recovery of debt insolvency

The recovery rate is calculated based on the time, cost and outcome of insolvency proceedings in each economy. To make the data on the time, cost and outcome of insolvency proceedings comparable across economies, several assumptions about the business and the case are used.

Assumptions about the business

The business:

- Is a limited liability company.

- Operates in the economy’s largest business city. For 11 economies the data are also collected for the second largest business city.

- Is 100% domestically owned, with the founder, who is also chairperson of the supervisory board, owning 51% (no other shareholder holds more than 5% of shares).

- Has downtown real estate, where it runs a hotel, as its major asset.

- Has a professional general manager.

- Has 201 employees and 50 suppliers, each of which is owed money for the last delivery.

- Has a 10-year loan agreement with a domestic bank secured by a mortgage over the hotel’s real estate property. A universal business charge (an enterprise charge) is also assumed in economies where such collateral is recognized. If the laws of the economy do not specifically provide for an enterprise charge but contracts commonly use some other provision to that effect, this provision is specified in the loan agreement.

- Has observed the payment schedule and all other conditions of the loan up to now.

- Has a market value, operating as a going concern, of 100 times income per capita or $200,000, whichever is greater. The market value of the company’s assets, if sold piecemeal, is 70% of the market value of the business.

Assumptions about the case

The business is experiencing liquidity problems. The company’s loss in 2018 reduced its net worth to a negative figure. It is January 1, 2019. There is no cash to pay the bank interest or principal in full, due the next day, January 2. The business will therefore default on its loan. Management believes that losses will be incurred in 2019 and 2020 as well. But it expects 2019 cash flow to cover all operating expenses, including supplier payments, salaries, maintenance costs and taxes, though not principal or interest payments to the bank.

The amount outstanding under the loan agreement is exactly equal to the market value of the hotel business and represents 74% of the company’s total debt. The other 26% of its debt is held by unsecured creditors (suppliers, employees, tax authorities).

The company has too many creditors to negotiate an informal out-of-court workout. The following options are available: a judicial procedure aimed at the rehabilitation or reorganization of the company to permit its continued operation; a judicial procedure aimed at the liquidation or winding-up of the company; or a judicial debt enforcement procedure (foreclosure or receivership) against the company.

Assumptions about the parties

The bank wants to recover as much as possible of its loan, as quickly and cheaply as possible. The unsecured creditors will do everything permitted under the applicable laws to avoid a piecemeal sale of the assets. The majority shareholder wants to keep the company operating and under her/his control. Management wants to keep the company operating and preserve its employees’ jobs. All the parties are local entities or citizens; no foreign parties are involved.

Time

Time for creditors to recover their credit is recorded in calendar years. The period of time measured by Doing Business is from the company’s default until the payment of some or all of the money owed to the bank. Potential delay tactics by the parties, such as the filing of dilatory appeals or requests for extension, are taken into consideration.

Cost

The cost of the proceedings is recorded as a percentage of the value of the debtor’s estate. The cost is calculated on the basis of questionnaire responses and includes court fees and government levies; fees of insolvency administrators, auctioneers, assessors and lawyers; and all other fees and costs.

Outcome

Recovery by creditors depends on whether the hotel business emerges from the proceedings as a going concern or the company’s assets are sold piecemeal. If the business continues operating, 100% of the hotel value is preserved. If the assets are sold piecemeal, the maximum amount that can be recovered is 70% of the value of the hotel.

Recovery rate

The recovery rate is recorded as cents on the dollar recovered by secured creditors through judicial reorganization, liquidation or debt enforcement (foreclosure or receivership) proceedings (figure 1). The calculation takes into account the outcome: whether the business emerges from the proceedings as a going concern or the assets are sold piecemeal. Then the costs of the proceedings are deducted (1 cent for each percentage point of the value of the debtor’s estate). Finally, the value lost as a result of the time the money remains tied up in insolvency proceedings is taken into account, including the loss of value due to depreciation of the hotel furniture. Consistent with international accounting practice, the annual depreciation rate for furniture is taken to be 20%. The furniture is assumed to account for a quarter of the total value of assets. The recovery rate is the present value of the remaining proceeds, based on end-2018 lending rates from the International Monetary Fund’s International Financial Statistics, supplemented with data from central banks and the Economist Intelligence Unit.

If an economy had zero completed cases a year over the past five years involving a judicial reorganization, judicial liquidation or debt enforcement procedure (foreclosure or receivership), the economy receives a “no practice” mark on the time, cost and outcome indicators. This means that creditors are unlikely to recover their money through a formal legal process. The recovery rate for “no practice” economies is zero. In addition, a “no practice” economy receives a score of 0 on the strength of insolvency framework index even if its legal framework includes provisions related to insolvency proceedings (liquidation or reorganization).

Strength of Insolvency Framework Index

The strength of insolvency framework index is based on four other indices: commencement of proceedings index, management of debtor’s assets index, reorganization proceedings index and creditor participation index.

Commencement of proceedings index

The commencement of proceedings index has three components:

- Whether debtors can initiate both liquidation and reorganization proceedings. A score of 1 is assigned if debtors can initiate both types of proceedings; 0.5 if they can initiate only one of these types (either liquidation or reorganization); 0 if they cannot initiate insolvency proceedings.

- Whether creditors can initiate both liquidation and reorganization proceedings. A score of 1 is assigned if creditors can initiate both types of proceedings; 0.5 if they can initiate only one of these types (either liquidation or reorganization); 0 if they cannot initiate insolvency proceedings.

- What standard is used for commencement of insolvency proceedings. A score of 1 is assigned if a liquidity test (the debtor is generally unable to pay its debts as they mature) is used; 0.5 if the balance sheet test (the liabilities of the debtor exceed its assets) is used; 1 if both the liquidity and balance sheet tests are available but only one is required to initiate insolvency proceedings; 0.5 if both tests are required; 0 if a different test is used.

The index ranges from 0 to 3, with higher values indicating greater access to insolvency proceedings. In Bulgaria, for example, debtors can initiate both liquidation and reorganization proceedings (a score of 1), but creditors can initiate only liquidation proceedings (a score of 0.5). Either the liquidity test or the balance sheet test can be used to commence insolvency proceedings (a score of 1). Adding these numbers gives Bulgaria a score of 2.5 on the commencement of proceedings index.

Management of debtor’s assets index

The management of debtor’s assets index has six components:

- Whether the debtor (or an insolvency representative on its behalf) can continue performing contracts essential to the debtor’s survival. A score of 1 is assigned if yes; 0 if continuation of contracts is not possible or if the law contains no provisions on this subject.

- Whether the debtor (or an insolvency representative on its behalf) can reject overly burdensome contracts. A score of 1 is assigned if yes; 0 if rejection of contracts is not possible or if the law contains no provisions on this subject.

- Whether transactions entered into before commencement of insolvency proceedings that give preference to one or several creditors can be avoided after proceedings are initiated. A score of 1 is assigned if yes; 0 if avoidance of such transactions is not possible or if the law contains no provisions on this subject.

- Whether undervalued transactions entered into before commencement of insolvency proceedings can be avoided after proceedings are initiated. A score of 1 is assigned if yes; 0 if avoidance of such transactions is not possible or if the law contains no provisions on this subject.

- Whether the insolvency framework includes specific provisions that allow the debtor (or an insolvency representative on its behalf), after commencement of insolvency proceedings, to obtain financing necessary to function during the proceedings. A score of 1 is assigned if yes; 0 if obtaining post-commencement finance is not possible or if the law contains no provisions on this subject.

- Whether post-commencement finance receives priority over ordinary unsecured creditors during distribution of assets. A score of 1 is assigned if yes; 0.5 if post-commencement finance is granted superpriority over all creditors, secured and unsecured; 0 if no priority is granted to post-commencement finance or if the law contains no provisions on this subject.

The index ranges from 0 to 6, with higher values indicating more advantageous treatment of the debtor’s assets from the perspective of the company’s stakeholders. In Mozambique, for example, debtors can continue essential contracts (a score of 1) and reject burdensome ones (a score of 1) during insolvency proceedings. The insolvency framework allows avoidance of preferential transactions (a score of 1) and undervalued ones (a score of 1). But the insolvency framework contains no provisions allowing post-commencement finance (a score of 0) or granting priority to such finance (a score of 0). Adding these numbers gives Mozambique a score of 4 on the management of debtor’s assets index.

Reorganization proceedings index

The reorganization proceedings index has three components:

- Whether the reorganization plan is voted on only by the creditors whose rights are modified or affected by the plan. A score of 1 is assigned if yes; 0.5 if all creditors vote on the plan, regardless of its impact on their interests; 0 if creditors do not vote on the plan or if reorganization is not available.

- Whether creditors entitled to vote on the plan are divided into classes, each class votes separately and the creditors within each class are treated equally. A score of 1 is assigned if the voting procedure has these three features; 0 if the voting procedure does not have these three features or if reorganization is not available.

- Whether the insolvency framework requires that dissenting creditors receive as much under the reorganization plan as they would have received in liquidation. A score of 1 is assigned if yes; 0 if no such provisions exist or if reorganization is not available.

The index ranges from 0 to 3, with higher values indicating greater compliance with internationally accepted practices. Nicaragua, for example, has no judicial reorganization proceedings and therefore receives a score of 0 on the reorganization proceedings index. In Estonia, another example, only creditors whose rights are affected by the reorganization plan are allowed to vote (a score of 1). The reorganization plan divides creditors into classes, each class votes separately and creditors within the same class are treated equally (a score of 1). But there are no provisions requiring that the return to dissenting creditors be equal to what they would have received in liquidation (a score of 0). Adding these numbers gives Estonia a score of 2 on the reorganization proceedings index.

Creditor participation index

The creditor participation index has four components:

- Whether creditors appoint the insolvency representative or approve, ratify or reject the appointment of the insolvency representative. A score of 1 is assigned if yes; 0 if no.

- Whether creditors are required to approve the sale of substantial assets of the debtor in the course of insolvency proceedings. A score of 1 is assigned if yes; 0 if no.

- Whether an individual creditor has the right to access financial information about the debtor during insolvency proceedings. A score of 1 is assigned if yes; 0 if no.

- Whether an individual creditor can object to a decision of the court or of the insolvency representative to approve or reject claims against the debtor brought by the creditor itself and by other creditors. A score of 1 is assigned if yes; 0 if no.

The index ranges from 0 to 4, with higher values indicating greater participation of creditors. In Iceland, for example, the court appoints the insolvency representative, without creditors’ approval (a score of 0). The insolvency representative decides unilaterally on the sale of the debtor’s assets (a score of 0). Any creditor can inspect the records kept by the insolvency representative (a score of 1). And any creditor is allowed to challenge a decision of the insolvency representative to approve all claims if this decision affects the creditor’s rights (a score of 1). Adding these numbers gives Iceland a score of 2 on the creditor participation index.

Strength of Insolvency Framework Index

The strength of insolvency framework index is the sum of the scores on the commencement of proceedings index, management of debtor’s assets index, reorganization proceedings index and creditor participation index. The index ranges from 0 to 16, with higher values indicating insolvency legislation that is better designed for rehabilitating viable firms and liquidating nonviable ones.

Reforms

The resolving insolvency indicator set tracks changes related to the efficiency and quality of insolvency framework every year. Depending on the impact on the data, certain changes are classified as reforms and listed in the summaries of Doing Business reforms in order to acknowledge the implementation of significant changes. Reforms are divided into two types: those that make it easier to do business and those changes that make it more difficult to do business. The resolving insolvency indicator set uses three criteria to recognize a reform.

First, all changes to laws and regulations that have any impact on the economy’s score on the strength of insolvency framework index are classified as reforms. Examples of reforms impacting the strength of insolvency framework index include changes in the commencement standard for insolvency proceedings, the introduction of reorganization procedures for the first time and measures to regulate post-commencement credit and its priority. Changes affecting the strength of insolvency framework index can be different in magnitude and scope and still be considered a reform. For example, implementing a post-commencement credit provision and designating it with certain priorities represents a reform with a potential two-point increase in the index, while changing the commencement standard from the balance sheet test to the liquidity test represents a reform with a half-point increase in the index.

Second, the impact of data changes on the time, cost or outcome of insolvency proceedings is assessed based on the absolute change in the overall score of the indicator set as well as the change in the relative score gap. According to the resolving insolvency methodology any update in legislation leading to a change of 0.5 points or more on the absolute score and 2% or more on the relative score gap of the recovery rate indicator is classified as a reform, except when the change is the result of variations to the interest rate (for more details, see chapter on the ease of doing business score and ease of doing business ranking). Minor fee updates or other small changes in the indicators that have an aggregate impact of less than 0.5 points on the overall score or 2% on the gap are not classified as reforms, but the data are updated accordingly.

Third, occasionally the resolving insolvency indicator set will acknowledge legislative changes with no current impact on the data as reforms. This option is typically reserved to legislative changes of exceptional magnitude such as sizeable revisions of corporate insolvency laws.

This methodology was developed by Djankov, Hart and others (2008) and is adopted here with several changes. The strength of insolvency framework index was introduced in Doing Business 2015. The good practices tested in this index were developed on the basis of the World Bank’s Principles for Effective Insolvency and Creditor/Debtor Regimes (World Bank 2011) and the United Nations Commission on International Trade Law’s Legislative Guide on Insolvency Law (UNCITRAL 2004).